Top 10 nonprofit payment processing platforms [2025 guide]

Nonprofit payment processing platforms are the backbone of fundraising.

In fact, three-quarters of customers are more likely to complete a purchase when one-click checkout is offered. These tools handle the complex technicalities of transactions, from processing credit and debit cards to managing recurring gifts and generating donation receipts.

Imagine a potential donor abandoning their online donation because the checkout process is clunky or insecure. Or your staff spending countless hours manually reconciling donation data. Selecting a payment processor that seamlessly integrates with the right donor management software is crucial to your fundraising success.

Let’s explore the top 10 nonprofit payment processing platforms that can take your fundraising initiatives to the next level.

| Payment processor | Best for | Standout feature | Payout time | Fees |

| Stripe | Flexible online payments | Customizable pages | Typically 2 business days | 2.2% + $0.30/ transaction |

| PayPal | Familiar online payments | Widespread recognition | 1-3 days, instant option | 2.29% + $0.09/ transaction |

| Charity Engine | Small/medium nonprofits | Varies by provider | Varies by plan | Subscription-based billing |

| Square | Online & in-person | Integrated POS | 1-2 days, instant option | 2.6% + $0.10/ transaction |

| iATS Payments | Small/medium nonprofits | Recurring donation management | 1-2 business days | Flat monthly fee |

| Authorize.Net | Secure online payments | Fraud prevention | 2-3 business days | 2.9% + $0.30/ transaction |

| Snowball Fundraising | Peer-to-peer fundraising | Mobile-first design | 2-3 business days | 2.9% + $0.30/ transaction |

| Clover | Event transactions | Integrated POS system | 1-3 business days | 2.3% + $0.10/ transaction |

| KeelaPay | Keela CRM users | CRM integration | 1-3 business days | 2.2% + $0.30/ transaction |

| Regpack | Events/ memberships | Registration management | 1-3 business days | $8/mo + 1.5%/ transaction |

Why do nonprofits need payment processing?

Nonprofits rely on donations to fulfill their missions and support their operations. And, accepting online payments is now essential for reaching a wider audience and making it easier for donors to contribute.

Not only does payment processing increase donor reach and convenience, but you can also reduce administrative overhead by eliminating manual handling of checks or cash through automation.

Common types of payment processing

Payment processors handle the technical complexities of transactions, ensuring secure fund transfers. Understanding these different types of payment processors is crucial for any nonprofit organization looking to better connect its financial operations with existing donor management software.

Credit and debit

Debit and credit card processing for nonprofits is one of the most common forms of electronic payment. When a donor makes a payment using a payment gateway, the processor facilitates the authorization of the transaction by communicating with the cardholder’s bank.

It allows nonprofits to accept donations from a wider audience, as credit and debit cards are widely used. It also offers the convenience of online donations, expanding fundraising reach. However, credit card processing typically comes with transaction and online donation fees, as well as sometimes monthly costs.

Bank transfer (ACH)

Automated Clearing House (ACH) transfers are electronic bank-to-bank payments processed through the ACH network. Donors authorize a direct debit from their bank account to the nonprofit’s account.

ACH payment processing for nonprofits is generally less expensive than credit card processing, as transaction fees are typically lower. That said, it can be slower than credit card payments, typically taking 1-3 business days to settle.

Mobile wallet

Mobile wallets, like Apple Pay and Google Pay, allow donors to make payments using their smartphones or other mobile devices. These wallets store card information securely and enable contactless payments using near-field communication (NFC) technology.

Mobile wallets offer a convenient way to donate, eliminating the need to enter card details manually — and streamlining the checkout process. However, this is the least popular payment method, so nonprofits may not see a significant increase in donations solely by offering this option.

10 notable nonprofit payment processing tools

Choosing the right payment processing tool is crucial for nonprofits to efficiently manage donations and maximize fundraising efforts. Let’s look at the 10 most notable payment processing tools for nonprofits.

1. Stripe

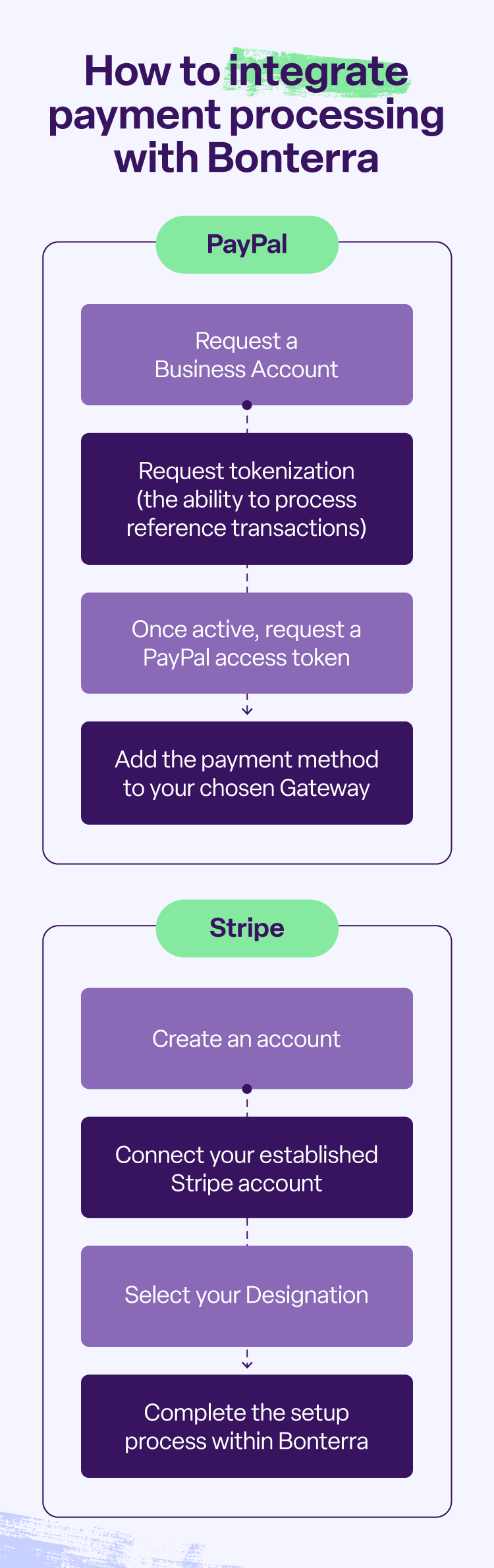

Stripe offers online payment processing for nonprofits and is known for its developer-friendly tools and features. It allows nonprofits to accept various payment methods, including credit and debit cards, Apple Pay, Google Pay, and ACH transfers. Bonterra accepts payments through Stripe to help increase supporter engagement.

Standout features

- Customizable payment pages: Tailor the donation experience to match your nonprofit’s branding and create a seamless flow for donors.

- Recurring billing: Easily set up and manage recurring donations, a crucial component of sustainable fundraising for many nonprofits.

- Fraud prevention: Stripe’s advanced fraud detection tools help protect your organization from fraudulent transactions, minimizing financial risk.

Recommended for: Flexible online payment processing

Payout time: Typically 2 business days

Fees: Starting at 2.2% + $0.30 per transaction

2. PayPal

PayPal is a widely recognized and trusted nonprofit donation processing platform, making it a familiar and accessible option for many donors. PayPal supports a variety of payment methods, including credit and debit cards, bank transfers, and payments directly from PayPal balances. Bonterra also integrates with PayPal for a streamlined and user-friendly experience.

Standout features

- Widely recognized and trusted: PayPal’s established reputation fosters trust and encourages donations, especially from those already familiar with the platform.

- Easy integration: PayPal integrates smoothly with various website platforms and fundraising tools, including Bonterra, simplifying the setup process for nonprofits.

- Mobile-friendly: PayPal’s mobile app lets donors easily contribute from their smartphones or tablets, enhancing convenience and accessibility.

Recommended for: Maximizing donor convenience

Payout time: Ranges from instant transfers to 3 business days

Fees: Starting at 2.29% + $0.09 per transaction

3. Charity Engine

Charity Engine is a payment processing platform designed for nonprofits offering a suite of tools to streamline donation management and enhance fundraising efforts. It focuses on providing a user-friendly experience for nonprofits and their donors, simplifying the process of accepting and managing online contributions.

Standout features

- Donor fundraising tools: Often include features to help organizations track donor information, manage relationships, and generate reports, simplifying donor stewardship.

- Recurring donation management: Facilitates the setup and management of recurring donations, a crucial aspect of sustainable fundraising.

- Customizable donation pages: Allow for the creation of branded donation pages to match organizational branding and create a seamless flow for donors.

Recommended for: Built-in donor management capabilities

Payout time: Varies based on your plan

Fees: Subscription-based billing

4. Square

While widely used by businesses, Square offers solutions that enable nonprofits to accept online donations, manage recurring giving, and process payments at events or on-site. Square supports various payment methods, including credit and debit cards, Apple Pay, Google Pay, and other contactless options.

Standout features

- Integrated POS system: Offers an integrated point-of-sale (POS) system, making it suitable for organizations that accept donations in person, at events, or through physical stores.

- Mobile payments: Provides mobile payment capabilities, allowing for payment acceptance from various locations using a smartphone or tablet.

- Simple pricing: Offers a generally straightforward pricing structure, making it easier to understand and manage processing costs.

Recommended for: Both online and in-person donations

Payout time: Ranges from instant transfers to 3 business days

Fees: Starting at 2.6% + $0.10 per transaction

5. iATS Payments

iATS Payments provides tools for accepting online donations, managing recurring gifts, and processing payments for fundraising events.

This solution emphasizes security and compliance, ensuring that donor data is protected. It also aims to simplify payment processing for nonprofits, allowing them to focus on their mission rather than administrative complexities.

Standout features

- Nonprofit focus: Designed with the needs of nonprofits in mind, often including features like discounted rates, recurring donation management, and software integration with nonprofit CRM systems.

- Fundraising event support: Offers tools to process payments for fundraising events, including online registration and on-site payment acceptance.

- Customizable donation pages: Allows for the creation of branded donation pages that can integrate with a website, enhancing the donor experience.

Recommended for: Fundraising event support

Payout time: Typically 1 to 2 business days

Fees: Flat monthly fee

6. Authorize.Net

Authorize.Net is a payment gateway that allows businesses, including nonprofits, to accept online payments securely. It provides payment processing for credit and debit card transactions, as well as eChecks.

While not exclusively designed for nonprofits, Authorize.Net’s comprehensive features and security measures make it a viable option for accepting online donations.

Standout features

- Fraud prevention tools: Offers tools to detect and prevent fraudulent transactions, minimizing financial risk.

- Recurring billing: Facilitates the setup and management of recurring donations, a key component of sustainable fundraising.

- Customer information management (CIM): Securely stores customer payment information for future transactions, simplifying repeat donations and improving the user experience.

Recommended for: A secure payment gateway

Payout time: Typically 2 to 3 business days

Fees: Starting at $25/mo and 2.9% + $0.30 per transaction

7. Snowball Fundraising

Snowball Fundraising is a platform designed to simplify and amplify nonprofit fundraising efforts. It provides tools for online donations and event management, aiming to make fundraising accessible for organizations of all sizes. Snowball also focuses on providing a mobile-optimized experience for both donors and fundraisers.

Standout features

- Peer-to-peer fundraising: Offers tools to empower supporters to raise funds on behalf of the organization, expanding reach and generating new donations.

- Recurring giving management: Facilitates the setup and management of recurring donations, a crucial component of sustainable fundraising. This often includes automated reminders and updates.

- Mobile-first design: Designed with mobile devices in mind, ensuring a seamless experience for donors and fundraisers on any device.

Recommended for: Mobile-friendly donations

Payout time: Typically 2 to 3 business days

Fees: Starting at 2.9% + $0.30 per transaction

8. Clover

Clover is a point-of-sale (POS) system that also offers payment processing capabilities, making it suitable for nonprofits that handle both online and in-person transactions.

While known primarily for its use in retail and restaurants, Clover’s platform can be adapted to the needs of nonprofits, enabling them to accept donations online, at events, or in physical locations.

Standout features

- Integrated POS system: The integrated POS system makes it ideal for nonprofits that require a comprehensive solution for online and in-person donation processing.

- App market: Clover’s app market allows nonprofits to extend the functionality of their POS system with various apps for donor management, reporting, and other nonprofit-specific needs.

- Customizable hardware: Offers a range of hardware options, from handheld terminals to countertop systems, allowing nonprofits to choose the equipment that best suits their needs.

Recommended for: Processing transactions at events

Payout time: Typically 1-3 business days

Fees: Starting at 2.3% + $0.10 per transaction

9. KeelaPay

KeelaPay is a payment processing solution integrated within the Keela CRM platform for nonprofits. It aims to simplify donation management by connecting payment processing with donor data and fundraising activities. This integration allows nonprofits to track donations while managing recurring giving.

Standout features

- CRM integration: KeelaPay integrates with its native CRM system, streamlining donation management and providing a consolidated view of donor activity.

- Automated reconciliation: KeelaPay automates the reconciliation of donations with donor records, saving time and reducing administrative overhead.

- Reporting capabilities: Generate comprehensive reports on donations and online fundraising performance directly within the Keela platform.

Recommended for: Nonprofits already using Keela CRM

Payout time: Typically 1-3 business days

Fees: Starting at 2.2% + $0.30 per transaction

10. Regpack

Regpack is a payment processing and registration platform designed for organizations that manage events, memberships, or programs requiring registration and payment collection. While not exclusively for nonprofits, its features can benefit organizations that host fundraising events, manage memberships, or offer fee-based programs.

Standout features

- Event and membership management: Designed to help manage registrations and payments for events, memberships, and programs, making it suitable for organizations that offer these types of activities.

- Customizable forms and workflows: Tailor registration forms and payment processes to meet specific requirements.

- Automated communication: Automate email confirmations, reminders, and follow-ups to participants, streamlining communication and reducing administrative overhead.

Recommended for: Fee-based program registration

Payout time: Typically 1-3 business days

Fees: Starting at $8/mo + 1.5% per transaction

Top credit card processing platform features to look for

Selecting the best payment processor for nonprofits requires careful consideration of several key features. Beyond simply accepting credit cards, the ideal platform should offer a suite of tools that streamline donation management, enhance donor experience, and minimize costs.

Minimal fees

For nonprofits, every dollar counts. Donation funds are crucial for supporting vital programs and services, and excessive fees can significantly erode the impact of those contributions. Therefore, minimizing online donation fees is critical when selecting a platform.

Some processors offer discounted rates specifically for nonprofits, which can significantly reduce costs. Others may offer tiered pricing based on transaction volume, so estimating your organization’s processing needs is important.

Simple setup and interface

Every moment spent wrestling with complex payment processing setups gives you less time to cultivate donor relationships, develop impactful programs, and, ultimately, achieve the organization’s mission. A payment processor with an easy setup and intuitive interface is crucial for minimizing administrative overhead and maximizing efficiency.

A clean and intuitive interface also reduces the learning curve for staff and volunteers, minimizing the need for extensive training and technical support. This is particularly important for smaller nonprofits with limited resources.

Flexible payment options

Donors have diverse preferences for how they contribute, and limiting payment methods can inadvertently create barriers to giving.

Providing a range of choices, from traditional credit and debit cards to digital wallets, ACH transfers, and even alternative payment methods like PayPal or Venmo, caters to these varied preferences and broadens the potential donor base.

Built for nonprofits

Payment processors built for nonprofits understand your unique needs and often provide tailored features that streamline donation segmentation and minimize costs.

One key benefit is often discounted transaction rates, recognizing the crucial role of donations in supporting charitable causes. Beyond cost savings and streamlined operations, these tools recognize the sensitive nature of donor information and offer robust security measures.

Quick payouts

Quick payouts from payment processors provide organizations with greater financial flexibility, more accurate financial visibility, and improved operational efficiency.

When donations are processed and deposited quickly, nonprofits have immediate access to funds, allowing them to respond promptly to emerging needs, seize time-sensitive opportunities, and avoid potential cash crunches.

Streamline your payments with an all-in-one solutions

Choosing the right nonprofit payment processing solution is crucial for any organization looking to optimize its fundraising strategy. Beyond the core functionalities, it’s essential to choose a program that integrates with your existing fundraising tools and systems.

Fundraising software, like Bonterra, features like recurring donation management, automated thank-you receipts, and detailed fundraising analytics can significantly boost efficiency and empower your organization to cultivate stronger donor relationships.

FAQ

How do nonprofits accept payments?

Nonprofits accept payments through various methods, including online payment processors, in-person cash or check collections, and mobile giving platforms.

What online payment system is best for nonprofits?

The “best” online payment system for nonprofits depends on the organization’s specific needs and size. However, Stripe and PayPal are both great options as they integrate with nearly every system.

Do nonprofits have to pay credit card processing fees?

Yes, nonprofits typically pay credit card processing fees, though some processors offer discounted rates for 501(c)(3) organizations. While they may be lower than standard commercial rates, these nonprofit credit card processing fees are usually unavoidable.

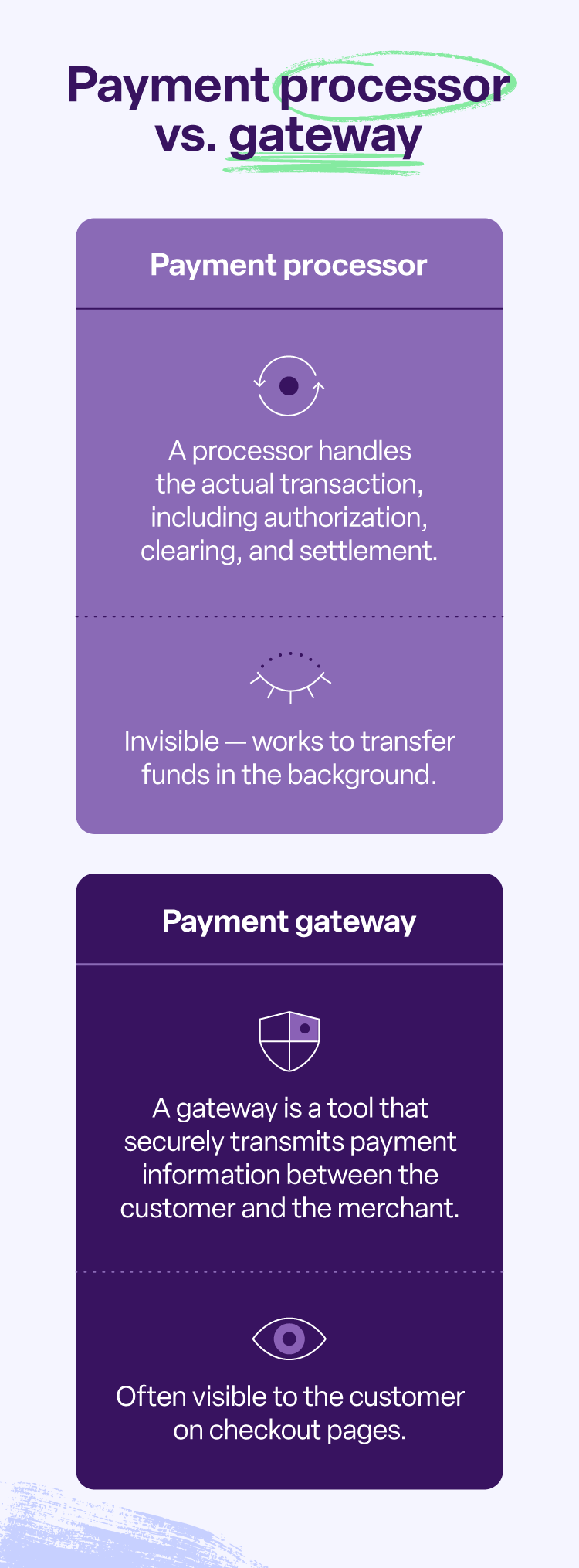

What is the difference between a payment gateway and a payment processor?

A payment gateway is like an online storefront, securely transmitting payment information between the customer (donor) and the merchant (nonprofit). A payment processor is the back-end engine that handles the actual transaction, communicating with banks and credit card networks to authorize and settle the payment.

Work with Bonterra