What is planned giving? A nonprofit’s guide to building a successful program

Key takeaways

Planned giving is a win-win for donors and nonprofits. It allows donors to support the causes they care about and leave a lasting legacy while giving nonprofits long-term funds to lean on for years to come.

Learn the different types of planned giving your organization can tap into and how this fundraising tool can help your nonprofit diversify funding streams, build long-term stability, and foster deeper connections with major donors.

What is planned giving?

Planned giving allows individuals and corporations to arrange a future gift to a nonprofit organization. Unlike traditional donations, planned gifts are typically deferred and realized at a later date, often after the donor’s lifetime.

The beauty of planned giving lies in its flexibility, as companies can structure future gifts in various ways, from bequests in wills to charitable trusts.

You may hear planned giving and legacy giving used interchangeably, but there is a subtle difference. Legacy giving is a specific type of planned giving where the gift is realized after the donor passes away. In a corporation’s case, a corporate will may outline a gift to be distributed upon the company’s dissolution.

Planned giving is the broader term, encompassing any gift planned in advance, regardless of when it’s realized. This includes gifts a donor made during their lifetime and those they deferred until after death.

Why planned giving is important

Planned giving is helpful for nonprofits seeking to secure sustainable, long-term funding. Unlike annual fundraising campaigns that focus on immediate needs, planned giving provides a predictable income stream that allows organizations to plan for the future.

These future gifts create a financial foundation to support ongoing programs, expand services, and launch new initiatives. This stable funding stream reduces reliance on fluctuating annual donations, which is especially vital for smaller nonprofits or in times of uncertain economic climates.

Tapping into this fundraising idea also fosters deeper relationships with donors, creating opportunities for increased engagement and further support opportunities.

When donors make a planned gift, they invest in the organization’s mission and express their belief in its long-term impact, allowing them to leave a legacy that reflects their values.

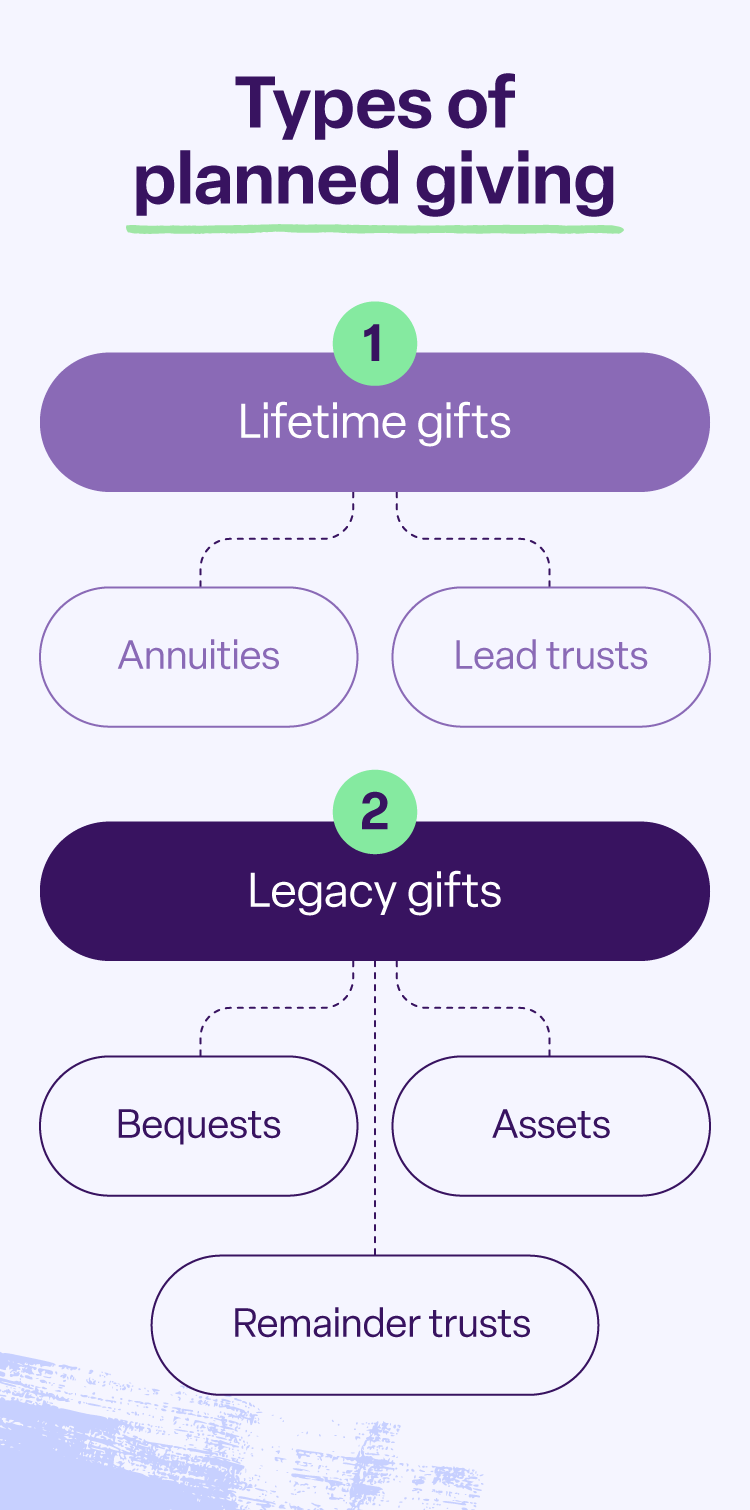

Common types of planned giving

From bequests in wills that leave a lasting legacy to charitable gift annuities that provide income during a donor’s lifetime, there are diverse types of planned giving that can be tailored to individual circumstances and philanthropic objectives.

Bequests

Bequests are legacy gifts made through a will or other estate planning document and are distributed to a nonprofit after the donor’s passing.

They’re one of the most common forms of planned giving because they’re relatively simple to arrange and allow donors to make a significant contribution without impacting their current financial resources.

Donors have a few options for structuring a bequest:

- A specific amount of money

- A percentage of the donor’s estate

- The remainder of the estate, after all other bequests are distributed

Example: A donor bequeaths 50% of their estate to a nonprofit after their death.

Annuities

Charitable gift annuities are contractual agreements between a donor and a nonprofit. The donor makes a significant contribution to the nonprofit, and in exchange, the organization promises to pay the donor (or another designated beneficiary) a fixed income for life.

The annuity payment is determined by factors like the donor’s age, the charity’s payout rate offer, and the gift’s size. After the donor or beneficiary’s death, the remaining funds in the annuity become a gift to the nonprofit.

This is a good option for donors who want to make a significant impact and receive an immediate tax deduction, all while protecting their income or ensuring the future income of a beneficiary. At the same time, nonprofits can invest and grow contributions.

| Pro-tip: Defer annuity payments until after retirement for larger payments. |

Example: A donor gives $50,000 to a nonprofit through a charitable gift annuity. In return, the nonprofit pays the donor a fixed annual income (e.g., $2,500 based on a 5% rate) for their lifetime. Upon the donor’s death, any remaining funds become a gift to the nonprofit.

Assets

Donating assets as part of a planned gift involves transferring ownership of specific assets to a nonprofit organization, often while retaining some benefit for the donor during their lifetime.

A common example is real estate property, where the donor uses the property until their death, at which point the nonprofit receives ownership.

Other assets could include retirement accounts, life insurance policies, or appreciated stock. The donor may receive a charitable deduction for the asset’s value while still benefiting from it during their lifetime.

Example: A donor gifts a retirement account to a nonprofit. While the donor is alive, they may be able to take distributions. After their death, the remaining funds in the account will go to the nonprofit.

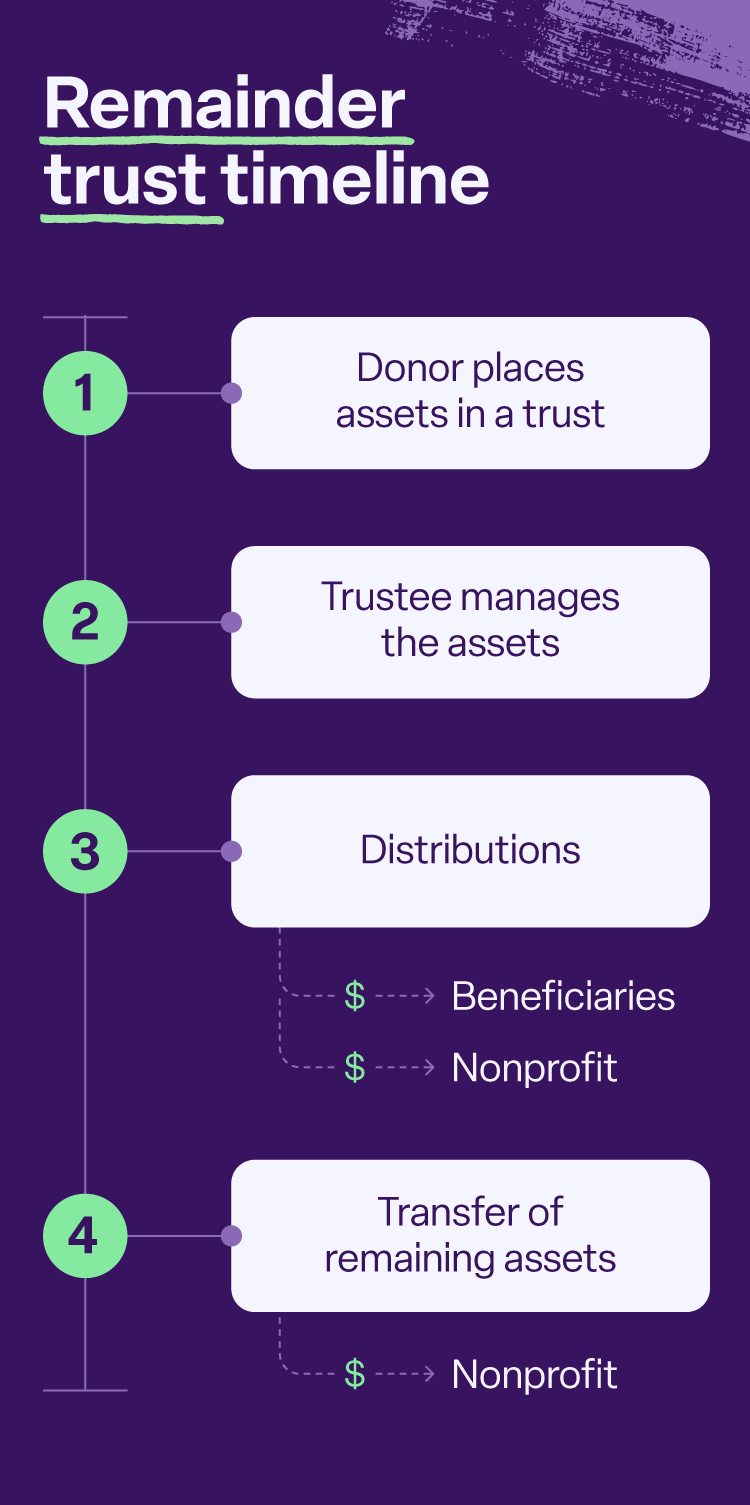

Trusts

Trusts are legal arrangements where a donor transfers assets to a trustee, who manages the assets for the benefit of both the donor (or other beneficiaries) and a nonprofit.

There are two main types:

- Remainder trust: A donor transfers assets into the trust, and the trustee invests those assets. The donor (or another beneficiary) receives an annual income from the trust for a specified term or life. At the end of the term, the remaining assets in the trust are distributed to the named charity.

- Lead trust: This trust pays a specified amount to the charity for a period of years, and then the remaining assets go back to the donor or their beneficiaries.

Example: A donor creates a remainder trust with $200,000 in stock, providing a beneficiary with annual payments equal to a fixed percentage (ex. 5%) of the trust’s assets. After the beneficiary’s death, the remaining trust assets are distributed to the designated charity.

How to start a planned giving program

Building a robust program takes time and dedication, from identifying potential donors and educating them about the various planned giving examples to establishing clear policies and procedures.

Here are the key steps involved in creating a program that can help your nonprofit secure its financial future.

Step 1: Organize your team

Building a successful planned giving program starts with assembling a dedicated team. This might involve designating and training existing team members to focus on planned giving or bringing in an expert if resources allow.

| Pro-tip: Form an advisory committee of lawyers, financial advisors, and realtors to help train your team on planned giving options so they can market and administer them more effectively. |

Regardless of the structure, you’ll want to define responsibilities for managing the program and establishing clear goals.

Step 2: Identify donor prospects

Start by analyzing your existing donor database. Who has a history of consistent giving, a strong connection to your mission, and a financial capacity to make a planned gift?

Look for donors who have made major gifts in the past, are involved in leadership roles, or have expressed an interest in leaving a legacy.

Once you’ve identified potential prospects, you should develop a personalized communication strategy. This could look like sending targeted mailings, hosting informational events, or scheduling one-on-one meetings.

The goal is to educate prospects on the benefits of planned giving and better understand how their philanthropic goals could fit into your mission.

Step 3: Create resources

Creating a range of resources, like brochures, a planned giving website, or informational videos, can help educate donors about the various types of planned giving and their benefits. These materials should be clear, concise, and easy to understand, avoiding overly technical jargon.

| Pro-tip: Consider creating a planned giving section on your website with FAQ, examples of planned gifts, and contact information for your planned giving officer. |

It’s also important to develop internal resources like gift acceptance policies and procedures, sample bequest language, and a system for tracking planned gifts.

Step 4: Steward donors

Securing a planned gift is just the beginning of the relationship. Stewardship is essential for thanking donors and keeping them engaged with your organization’s mission.

This might involve sending personalized thank-you notes, inviting them to special events, or providing regular updates on how their gifts are making a difference.

By staying in touch and demonstrating the impact of their gifts, you can foster a deeper sense of connection and loyalty, encouraging future support.

Top benefits of planned giving

For donors, planned giving is a way to leave a lasting legacy and potentially achieve financial benefits like tax savings or increased income. For nonprofits, planned giving provides a vital source of long-term funding.

Understanding these key benefits and incorporating planned giving best practices is essential for any organization looking to secure sustainable financial health.

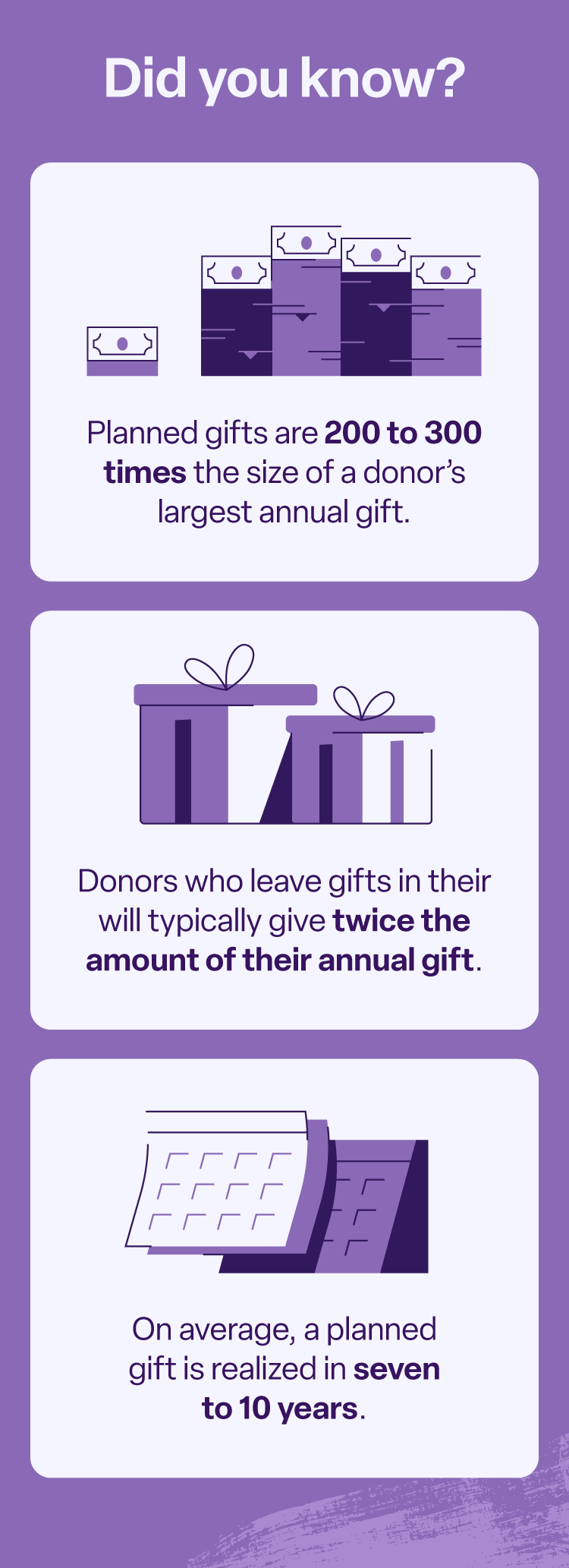

Increases funding

Planned giving provides a pipeline of future gifts, often substantial in size, that can be anticipated and factored into long-term financial planning.

These future gifts can be significantly larger than annual donations, dramatically increasing the organization’s capacity to fund major projects, expand programs, and invest in its long-term growth.

Ensures long-term stability

Planned giving provides a predictable income stream that allows organizations to confidently invest in programs, staff, and infrastructure, knowing that future resources are secured.

A strong planned giving program acts as an endowment, ensuring the organization can fulfill its mission far into the future.

By focusing on planned giving, nonprofits can shift from a short-term fundraising cycle mentality to a long-term, strategic growth mindset.

Builds donor relationships

Donor stewardship with existing planned giving donors can elevate the potential for securing additional major gifts during a donor’s lifetime, as planned giving opens the door to conversations about current giving opportunities.

A robust planned giving program can also attract major donors with long-term vision and a desire to make a significant impact. These donors are often more inclined to make major gifts, knowing their contributions will support the mission for generations to come.

Tax deductions for donors

Many planned giving options, like annuities or trusts, offer immediate tax deductions for a portion of the gift’s value. These deductions can reduce a donor’s current income tax liability, freeing up resources for other philanthropic or personal goals.

Other planned gifts like bequests can reduce estate taxes, allowing donors to pass on more of their assets to their heirs while also supporting their favorite charities.

Secure more planned gifts for long-term growth

Planned giving is a powerful way for your nonprofit to create a sustainable future. When you pair your planned giving program with a strong donor management system, you can capitalize on donors wanting to make a lasting impact on your organization.

Ready to get started with your planned giving program? Request a demo today.

FAQ

What is a planned giving program?

A planned giving program allows donors to make charitable gifts to a nonprofit over time or through their estate plans. These gifts are typically larger than annual donations and can provide a significant source of funding for the nonprofit.

Is a bequest the same as planned giving?

A bequest is a type of planned gift, but planned giving encompasses a broader range of giving options.

What is the difference between planned giving and major gifts?

Both planned giving and major gifts are significant contributions to a nonprofit, but they differ in structure and timing. Major gifts are typically large, one-time donations, while planned gifts are arranged over time or through estate planning.

What are the tax benefits of planned giving?

Planned giving can offer donors tax benefits like income tax deductions, capital gains tax avoidance, and estate tax reductions. The specific benefits depend on the type of planned gift and the donor’s circumstances.

Work with Bonterra