The basics of corporate matching gifts: complete breakdown

Of the $5 billion contributed through corporate giving annually, over 50% comes from one type of program: matching gifts. Through these programs, companies and their employees join forces to amplify their support for charitable organizations and make a greater impact on value-aligned causes. But why do companies and nonprofit organizations continue to prioritize this type of giving?

In this guide, we’ll explain everything you need to know about matching gifts, including why it’s one of the country’s top corporate social responsibility (CSR) programs. Whether you’re a corporate leader, nonprofit, or employee looking to take advantage of these programs, we have the answers you need.

What are matching gifts?

Matching gifts, also known as donation matching programs, are a type of corporate giving program where businesses match their employees’ monetary donations to eligible organizations.

Depending on the company’s guidelines and match ratio, it may double or even triple its employees’ original gift. For example, if an employee gives $50, their employer might donate an additional $50, resulting in $100 for the nonprofit, maximizing your company’s overall impact.

Why are corporate matching gifts so popular?

With over 26 million people benefitting from matching gift programs and companies donating $2-3 billion annually, donation matching has become one of the most powerful forms of corporate philanthropy. But what makes these programs so impactful?

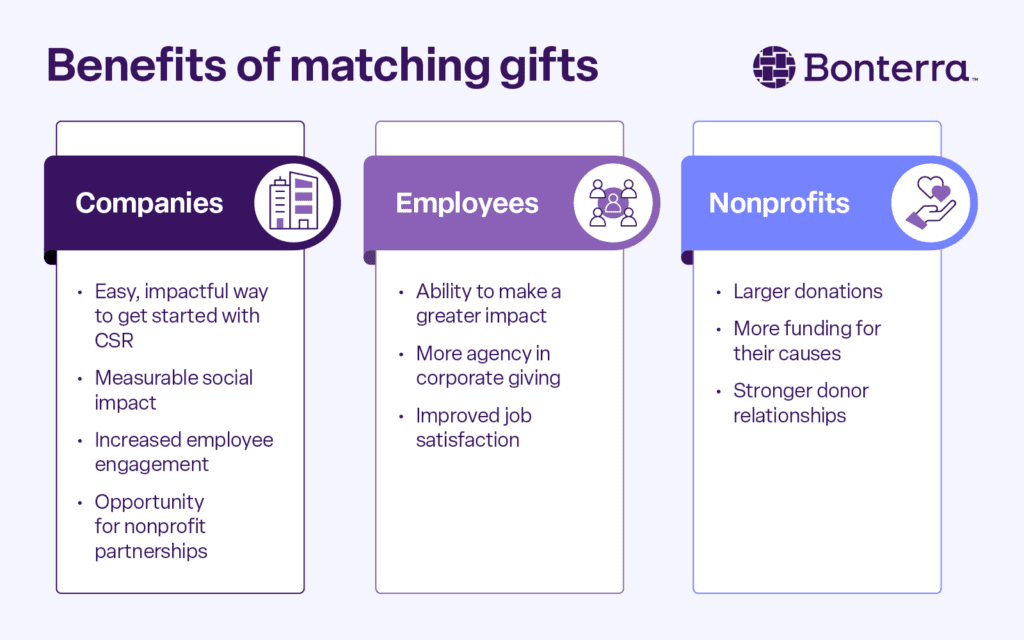

The answer lies in the compelling benefits they offer businesses, employees, and nonprofits:

Benefits for companies

For many companies, matching gifts are the cornerstone of their employee giving programs. This is because these programs offer businesses:

- An easy, impactful way to get started with CSR: Matching gift programs are straightforward and simple — employees donate, the company matches, and everybody wins. They’re also easy for companies to set up and have big impact potential, making them the perfect gateway into the world of corporate philanthropy.

- Measurable social impact: Since matching gifts are so straightforward, they’re also easy to track and report on. Companies can track the total funds donated, number of donations matched, and number of organizations supported to demonstrate how they’re making a difference in communities.

- Increased employee engagement: Employees want the businesses they work for to amplify their own philanthropic efforts. Through matching gifts, companies can show their employees that they value the same causes and are committed to supporting them, resulting in greater employee satisfaction and engagement.

- Facilitated nonprofit partnerships: Most matching gift programs are employee-led, empowering your workforce to select the organizations your company supports. This can expose your company to untapped partnership opportunities.

In addition to these benefits, well-run matching gift programs can boost retention, revenue, and brand reputation.

Benefits for employees

BotBoth employees who regularly donate to nonprofits and those new to charitable giving platforms can benefit from matching gift programs. Typical benefits for employees and donors include:

- Opportunity to make a greater impact: Donors give to make a personal impact on the causes they care about. Matching gifts enable them to double their donations at no extra cost, amplifying their support for the nonprofits they love.

- More agency in corporate giving: Matching gifts are employee-led giving programs that give employees the flexibility to choose where to direct corporate funds. This agency makes employees feel empowered and excited to participate in their company’s CSR efforts.

- Improved job satisfaction: Most employees want their employers to be philanthropic — a corporate investments report found that 90% of Gen Z workers think companies must act on social and environmental issues. When they participate in matching gift programs, employees see the impact of corporate philanthropy up close and feel more satisfied with their employers.

Employees who are actively engaged in matching gifts and other corporate giving programs may even be inspired to increase their involvement with nonprofits outside of work. There are countless benefits of volunteering for employees, such as improving mental health and broadening social networks.

Benefits for nonprofits

NonprofitNonprofits love matching gifts, too. When their supporters request an employer match, they gain benefits like:

- Larger donations: America’s Charities reports that one in three donors would increase the size of their donations if a corporate match were offered. Simply marketing matching gifts can encourage donors to upgrade their support and give more.

- More funding for their causes: Donation matching means nonprofits receive double the funding, allowing them to do more with your dollars.

- Stronger donor relationships: Since matching gifts incentivize donors to give more, they can also pave the way for deeper, long-lasting relationships. Donors may decide to increase their giving long-term and get more invested in the nonprofit’s work.

To help nonprofits tap into these benefits, companies should promote matching gift opportunities and remind employees to submit a request. Sending automated email reminders about available balances and highlighting their potential impact can help increase the number of employees who submit a request.

Common matching gift program guidelines

Whether you’re a company looking to start your own matching gift program, an employee interested in participating, or a nonprofit looking to make the most of this fundraising opportunity, you need to understand a few key guidelines.

Matching gift programs come in all shapes and sizes, depending on how companies structure the following:

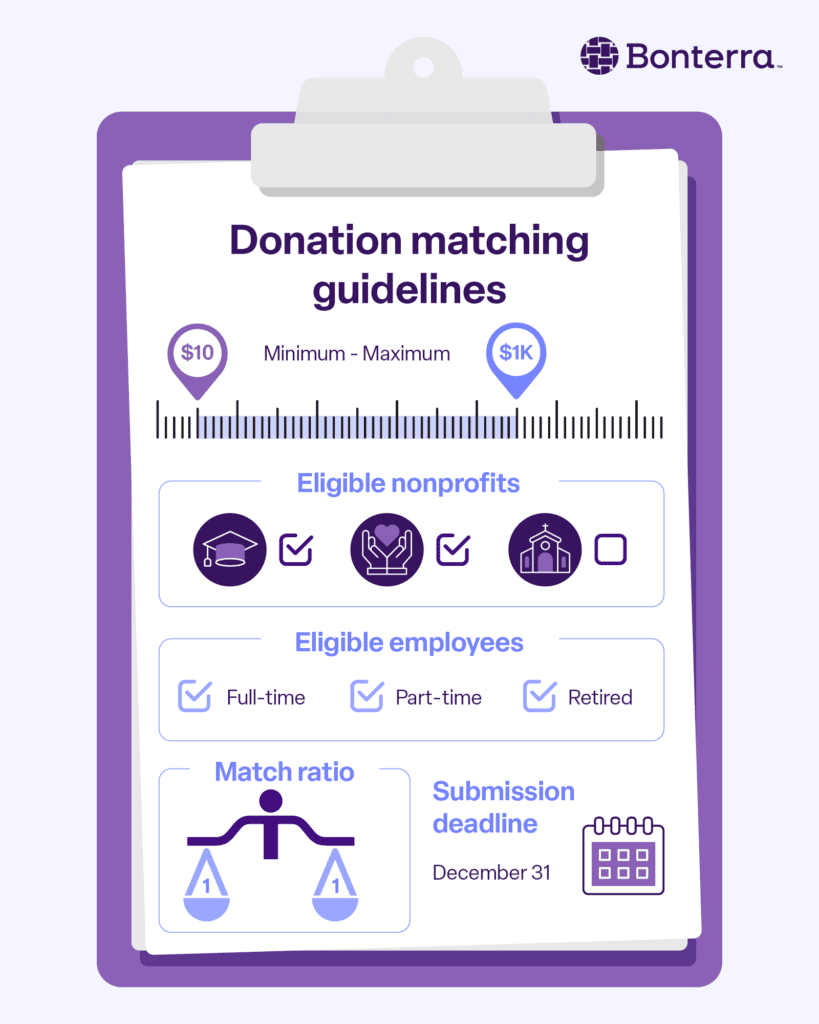

Minimum and maximum gift sizes

Each corporate matching gifts program has restrictions on which donations the company will match. Some companies match donations of any size up to a certain amount, but most set both a minimum and maximum eligible gift size. For example, a company might set a $10 donation minimum and a $1,000 maximum, meaning it will only accept match requests for donations within that range.

Eligible organizations

Most companies set parameters for the type of nonprofit organizations they’re willing to support with matching gifts. Some are more restrictive, offering only a list of specific nonprofits their employees can donate to with corporate funds. Other corporations may match donations to any registered 501(c)(3) organization, while others exclude schools or religious organizations.

These guidelines are especially important for nonprofits to know when they promote matching gift opportunities. Since every company is different, most nonprofits encourage their donors to research their employers’ matching gift guidelines on their own or provide a tool they can use to search for their company.

Eligible employees

Not every employee can request a matching gift from their employer — some companies only allow full-time staff to participate in their giving programs. However, many other businesses consider part-time and even retired employees eligible for matching gifts. This is a guideline that employees should be proactive about checking before they request a matching gift.

Match ratio

CCompanies match donations at a set ratio, such as 1:1 or 2:1. With a 1:1 match (the most common ratio), the company matches eligible donations dollar for dollar. In practice, here’s what popular match ratios look like:

- 0.5:1 ratio: $50 employee gift + $25 corporate gift = $75 total

- 1:1 ratio: $50 employee gift + $50 corporate gift = $100 total

- 2:1 ratio: $50 employee gift + $100 corporate gift = $150 total

Most companies have a single match ratio that applies to all matching gifts, but some offer special ratios for certain causes. For example, Nike’s program has a regular 1:1 ratio and a 2:1 match ratio for donations to sports-related nonprofits.

Submission deadlines

Employees must submit match requests by a specified deadline to be eligible for matching. Often, submission deadlines are either the end of the calendar year (December 31) or the end of the company’s fiscal year.

Breaking down the matching gift request process

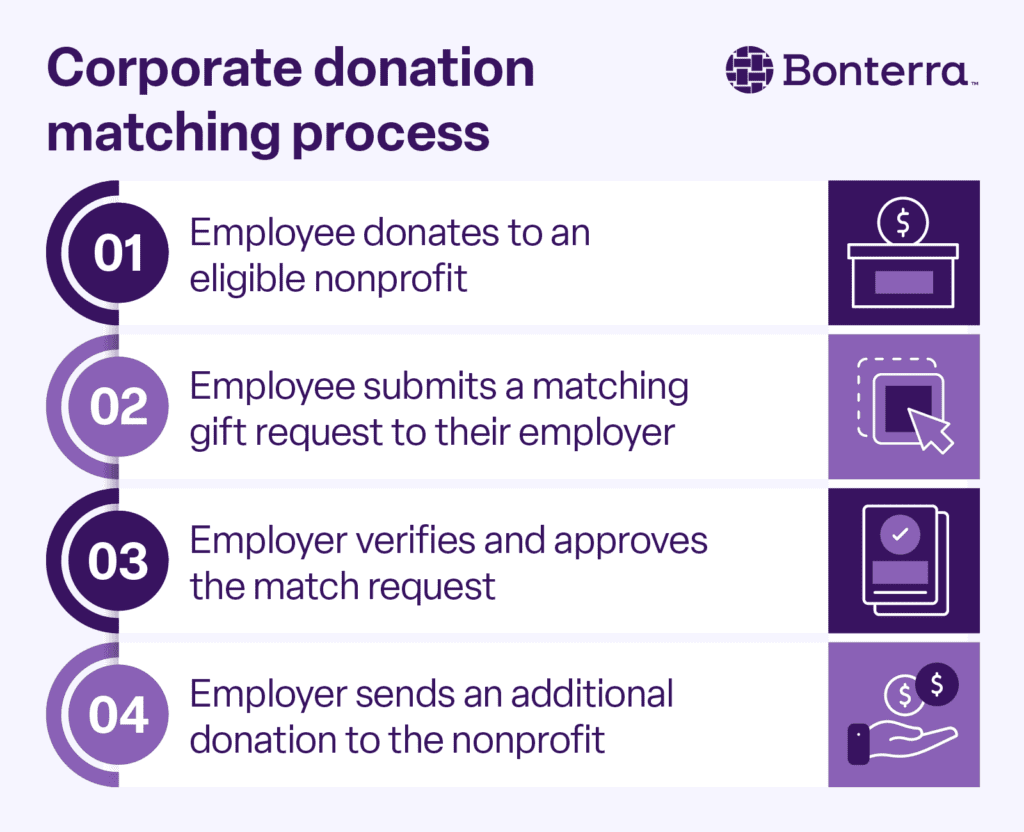

One of the most common questions people have about matching gifts is, “How do I request a match?” While the request process can vary slightly from company to company, the basic process works like this:

- An employee donates to a nonprofit. The employee might donate directly through the nonprofit’s website or via a company CSR platform.

- The donor submits a matching gift request to their employer. If the employee donated to the organization directly, they must report the specifics of the donation to their employer using a match request form. This includes the donation amount, date, organization name, Tax ID number, and more.

- Their employer verifies and approves the match request. Upon receiving the request, the employer or their CSR platform verifies the details listed in the request and that the donation meets all eligibility requirements.

- The employer sends the nonprofit an additional donation. If approved, the company sends a donation at the specified ratio to the nonprofit.

The donating employee initiates the process and provides gift details, while the company handles verification and fund disbursement. Nonprofits have more of a backseat role — they simply remind donors to submit requests and confirm the gift information is correct.

Exactly how employees submit match requests to their employers depends on their company’s guidelines and resources. Some companies still use paper request forms and a manual verification process, while others automate the process using CSR software. If the business uses a CSR platform, the employee typically enters an employee portal and inputs their donation information there.

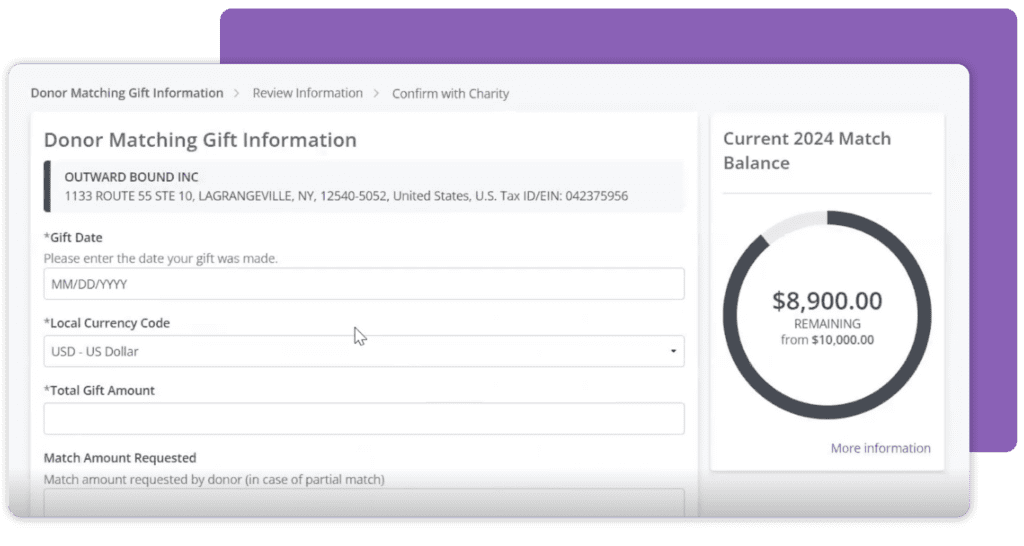

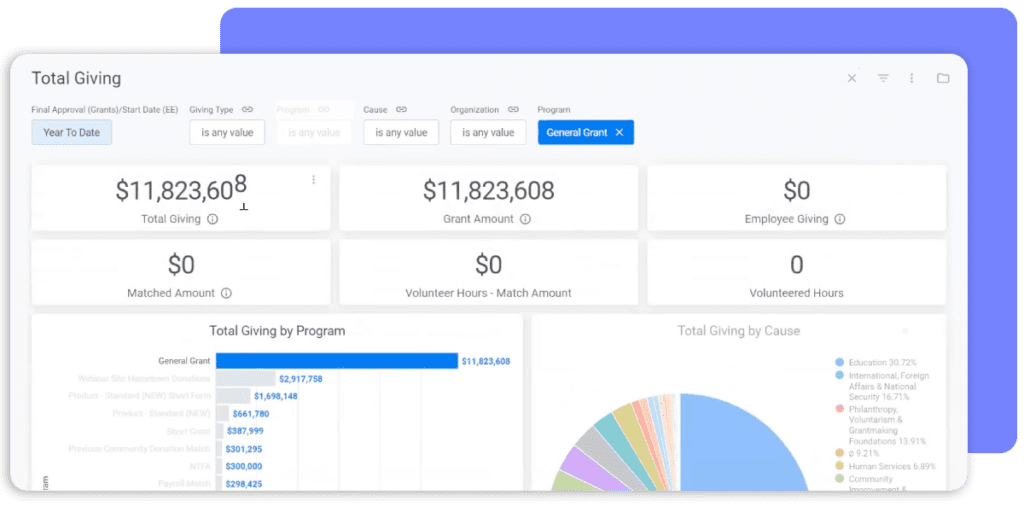

For example, companies using Bonterra CyberGrants can provide their employees with access to custom portals and match request forms like this one:

From here, employees can easily input their donation information and see how much corporate funding they can put toward matching gifts for the rest of the year. Or, if they donate directly through the platform, eligible donations will be automatically matched without the need to submit a request.

Top matching gift programs to explore

Since thousands of companies offer matching gifts and program specifics vary, we’ve compiled a list of a few top matching gift programs that serve as good examples. Each of these companies offers a robust employee giving program that includes matching gifts:

- CVS Health uses Bonterra’s CSR software to match donations made by part-time and full-time employees at a 1:1 ratio. With our help, they also launched a disaster relief campaign for Ukraine that raised $50,000 in matched donations in just 24 hours.

- Johnson & Johnson matches employee donations to most 501(c)(3) organizations up to $20,000. Director-level donations even get matched at a 2:1 ratio.

- Clif Bar & Company offers matching gifts for part-time and full-time employees up to $2,500 at a 1:1 ratio.

- The Walt Disney Corporation offers a generous matching gift maximum of $25,000 and an extensive employee volunteering program.

- Pfizer matches employee donations up to $5,000 at a 1:1 ratio year-round and matches donations at a 2:1 ratio during certain seasonal campaigns.

- General Electric has matched over $1.5 billion in employee donations since its inception through the GE Aerospace Foundation.

- Microsoft will match donations of up to $15,000 to most nonprofits, including educational institutions and arts and cultural organizations.

- Google allows employees to request up to $10,000 in matching gift funds for personal donations and up to $10,000 for disaster relief campaign donations.

- Chevron offers two matching gift maximums — a $10,000 maximum for current full-time employees and a $3,000 maximum for retired employees.

- Verizon has a regular matching gifts program and a Team Champions program in which the company matches funds raised by teams of employees.

If your company wants to develop a matching gift program, explore these examples to get a feel for the landscape, norms, and standout programs. These companies can inspire your own workplace philanthropy programs, even beyond matching gifts.

How to boost employee engagement with matching gifts

For companies looking to start or improve their matching gift programs, use these tips to encourage employee participation and engagement, ultimately leading to more CSR impact.

Make it easy for them to request a match

First and foremost, set up your program so that employees don’t have to jump through hoops to submit match requests. This means streamlining your request process with CSR software, making matching gift program guidelines readily available for employees, and sending occasional reminders to participate in the program.

The more convenient it is to participate — whether that means fully automating the request process or adding a link to your employee CSR portal on your website — the more likely your employees are to actually request matches.

Leverage your CSR software’s engagement features

Most corporate giving platforms come with features designed to help you engage employees and boost participation. These might include:

- Personalized employee dashboards

- Giving suggestions based on preferences

- Individual impact metrics and tracking

- Social and activity feeds to share giving wins

- Flexible payment options

- Tools to create volunteer events

Explore the engagement features your CSR software has to offer, and start using them to meet your company’s unique needs and goals. For example, if your employees request a match after volunteering, consider encouraging your team to create volunteer events within the portal to drive more requests.

Encourage your nonprofit partners to promote matching gifts

If your company already has strong nonprofit partnerships, discuss your matching gift program with them. Explain the benefits and highlight your shared values, then ask if they’d be willing to promote your matching gifts program and others like it to their donors.

You might even partner with a nonprofit for a custom program where you offer matches at a higher rate on a certain day, like GivingTuesday. This not only encourages your employees to request matches quickly, but it also improves your company’s relationship with the nonprofit you work with.

Increase the impact of matching gifts with Bonterra

Today, 50% of Fortune 500 companies choose our robust, customizable CSR software built on CyberGrants.

Our software empowers corporations of all sizes to increase their philanthropic impact by helping them:

- Simplify and streamline the matching gift request process. Centralize matching gift requests, automatically calculate eligibility, and automate disbursements.

- Provide employees with a database of verified nonprofits they can support. Access our FrontDoor Marketplace to search for vetted, value-aligned nonprofits.

- Build tailored giving programs that meet your company’s exact needs. Set custom matching gift guidelines, employee access controls, and workflows.

- Manage all employee giving programs from one place. House data about matching gifts, employee volunteering, grantmaking, and more in a central location.

- Easily report on the impact of matching gifts and other CSR programs. Create custom reports and dashboards in just a few clicks to analyze your company’s impact.

Once you build out and optimize your company’s matching gifts program, you can also leverage Bonterra’s CSR software to scale your philanthropic efforts over time. Branch out with digital wallets, volunteer time off (VTO), charitable spending accounts (CSAs), and more.

Getting started with matching gifts

Matching gifts may seem complicated at first, but they’re worth the investment. If you have questions about providing, requesting, or promoting matching gifts, refer back to this guide. If your company wants to learn more about launching a successful matching gifts program with Bonterra, don’t hesitate to reach out to our team — we’re always here to help.

Streamline and accelerate your matching gifts program with Bonterra.

Work with Bonterra